Embarking on the journey of company registration in Indonesia is a crucial step for entrepreneurs aiming to expand their business in Southeast Asia’s burgeoning market. Navigating through the process, from understanding the latest requirements at the company registration office to obtaining a registration certificate, is essential for establishing a legitimate business presence. This crucial inception phase not only lays the groundwork for your venture but also impacts your business’s operational capabilities and legal recognition.

In this comprehensive guide, we will delve into the nuances of various legal entities and provide a step-by-step walkthrough of the registration process, ensuring you are well-equipped with the knowledge to secure your business registration effectively. Our discussion will extend to key requirements needed for a successful registration of a company and the post-registration formalities to adhere to, ensuring a smooth transition into Indonesia’s dynamic market environment. Through this exploration, our aim is to impart clarity and ease the complexity associated with establishing a corporate entity in Indonesia.

Understanding the Types of Legal Entities in Indonesia

In Indonesia, entrepreneurs can choose from several legal entities, each with specific characteristics and regulations. We will explore the primary types: PT (Local Company), PT PMA (Foreign-Owned Company), Representative Office (KPPA), and Joint Ventures and Partnerships.PT (Local Company)

A Perseroan Terbatas (PT) is a locally owned limited liability company. This entity is ideal for Indonesian nationals as legislation requires that all shareholders be Indonesian citizens. PTs are favored for their flexibility and protection of personal assets against company liabilities.PT PMA (Foreign-Owned Company)

The PT PMA allows foreign investors to own company shares, operate businesses, and sponsor foreign employees in Indonesia. It is subject to the Negative Investment List, which dictates the sectors open to foreign investment and those that are restricted.Representative Office (KPPA)

A KPPA acts as a liaison for its parent company, handling market research and other non-commercial activities within Indonesia. It cannot engage in profit-making activities but is useful for foreign companies assessing market conditions or establishing a presence before launching a PT PMA.Joint Ventures and Partnerships

These arrangements allow foreign and local companies to collaborate, sharing resources and risks. Often used to navigate sectors with restrictions on foreign ownership, joint ventures require careful planning and flexible agreements to adapt to Indonesia’s dynamic market conditions.Step-by-Step Guide to Registering a Company

1. Get the Deed of Establishment

Start by choosing a legal company name, which must consist of at least three different words as per Indonesian law. Engage a notary to draft your Articles of Association, detailing your company’s name, location, capital, and business activities.

Both you and your shareholders must sign the Deed of Establishment in the presence of a notary, who will then submit it for approval by the Indonesian Ministry of Justice and Human Rights.

Start by choosing a legal company name, which must consist of at least three different words as per Indonesian law. Engage a notary to draft your Articles of Association, detailing your company’s name, location, capital, and business activities.

Both you and your shareholders must sign the Deed of Establishment in the presence of a notary, who will then submit it for approval by the Indonesian Ministry of Justice and Human Rights.

2. Acquire a Company Tax Number (NPWP)

Following the approval of your Deed of Establishment, apply for a company tax number at your local office. This NPWP is essential for tax purposes and will be sent to your company’s address.

In Jakarta, a domicile letter is no longer required with the new law passed in May 2019.

Following the approval of your Deed of Establishment, apply for a company tax number at your local office. This NPWP is essential for tax purposes and will be sent to your company’s address.

In Jakarta, a domicile letter is no longer required with the new law passed in May 2019.

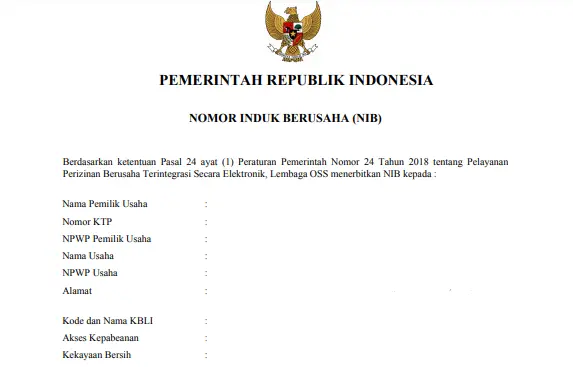

3. Obtain a Business Registration Number (NIB)

With the Online Single Submission (OSS) system, you can easily obtain your NIB, which also serves as your Importer Identification Number. This process simplifies the administrative procedures, allowing you to also register for health and social security programs and participate in business tenders in Indonesia.

With the Online Single Submission (OSS) system, you can easily obtain your NIB, which also serves as your Importer Identification Number. This process simplifies the administrative procedures, allowing you to also register for health and social security programs and participate in business tenders in Indonesia.